Choosing the best crypto trading bot 2025 can help improve your strategy and stay ahead in today’s fast-moving markets. The right AI-powered bot can automate trades around the clock, react quickly to price changes, and avoid costly emotional decision-making. However, with many bots offering various features, fees, and strategies, choosing the right one can impact your success as a crypto trader.

In this guide, we reveal bots that truly deliver, saving you time, protecting your assets, and maximizing profits. From price comparisons to trusted trading strategies, we’ll help you find the platform that matches your goals and lets you trade more efficiently.

Best Crypto Trading Bots in 2025: Overview Comparison

| Bot Name | Pricing | Customization | Supported Exchanges | Trading Strategies | Ideal For |

| Cryptohopper | Free – $107.50/month | High (Strategy designer, AI learning) | 18+ (Binance, Coinbase, KuCoin) | Arbitrage, Market-Making, Social Trading, DCA | AI-driven automation and social trading |

| 3Commas | $15 – $160/month | High (SmartTrade terminal, custom signals) | 15+ (Binance, Coinbase Pro, Kraken) | DCA, Grid, Options, Custom Signals | Professional traders seeking advanced control |

| Pionex | Free (0.05% fee) | Low (16 pre-configured bots) | 1 (Pionex Exchange) | Grid Trading, DCA, Arbitrage, Rebalancing | Beginners and free built-in bots |

| Coinrule | Free – $449.99/month | High (Rule-based templates) | 10+ (Binance, Kraken, Coinbase) | Rule-based automation, DCA, Stop-Loss | Beginners preferring no-code automation |

| Hummingbot | Free (Open-source) | Very High (Python customization) | 40+ (Centralized & Decentralized) | Market-Making, Arbitrage, Liquidity Cloning | Developers and market makers |

| HaasOnline | Customized pricing | Very High (HaasScript, visual editor) | 19+ (DEXs & Futures platforms) | Market-Making, Arbitrage, Scalping | Advanced traders needing deep customization |

| Bitsgap | $23 – $120/month | High (Advanced order types, bots) | 16+ (Bybit, Binance, Coinbase) | Grid, DCA, COMBO Futures Trading | Serious traders using multiple exchanges |

| Altrady | €20 – €63/month | High (Signal bots, advanced orders) | 17 Spot & 4 Futures | Signal, Grid, DCA, Trailing Stops | Portfolio management and bot trading |

| Mizar | Free – $30/month | Medium (TradingView integration) | 11+ (Spot & Futures) | Social Trading, DCA, Smart Trading | Social and copy trading |

| Shrimpy | Free – $39/month | Medium (Rebalancing rules) | 8+ (Binance, Coinbase, Kraken) | Portfolio Rebalancing, Social Trading, DCA | Long-term portfolio management |

10 Best AI Crypto Trading Bots: Expert Reviews

1. Cryptohopper – Best for AI-Driven Automation and Social Trading

Cryptohopper is a powerful and versatile crypto trading bot designed to help you automate your trading, no matter your experience level. It’s a flexible, AI-powered platform that makes automated crypto trading approachable for everyone-from complete beginners to advanced traders. It connects to your preferred crypto exchange and trades on your behalf, following the strategy you set. Whether you want to copy experienced traders, design your own complex strategies, or find arbitrage opportunities, Cryptohopper is one of the best crypto trading bots to explore.

Cryptohopper is an excellent choice for traders who want to leverage artificial intelligence and community-driven strategies. Its AI can learn from your own strategies to adapt to market changes, making your trading smarter over time. For beginners, the social trading features are a standout. You can easily browse a marketplace of strategies, templates, and signals from seasoned traders, and even copy their trading bots directly. This makes it a great entry point for those who want to start automating trades without building everything from scratch.

Pros & Cons of Cryptohopper

| Pros | Cons |

| User-friendly interface suitable for all skill levels. | The best AI features are limited to the most expensive plan. |

| Cloud-based, so it operates 24/7 without your device. | The sheer number of features can be overwhelming for new users. |

| Robust social trading marketplace for copying strategies. | Requires an active subscription for most automated features. |

| Supports a wide range of popular exchanges and features powerful backtesting and paper trading tools. |

Trading Strategies

Cryptohopper offers a wide array of trading strategies to fit different goals and risk appetites. You can fully customize your approach or use pre-built ones.

- Algorithmic and AI Trading: You can design your own trading strategies using over 130 indicators and candlestick patterns. The AI feature allows you to test and train your bot to recognize the best investment strategy for the current market.

- Arbitrage: The bot can exploit price differences for the same coin across different exchanges, helping you profit from market inefficiencies.

- Market-Making: For more advanced users, the market-making bot can place buy and sell orders to profit from the spread on low-volume trading pairs.

- Social and Copy Trading: You can subscribe to Telegram signals from third-party analysts or directly copy the entire setup of a successful trader from the marketplace.

- Dollar-Cost Averaging (DCA): You can set your bot to buy into a position at set intervals, helping to average out your purchase price and reduce the impact of volatility.

Pricing Plans

Cryptohopper offers several tiers, including a free option to get you started.

- Pioneer (Free): This plan is great for getting a feel for the platform. It includes portfolio management and manual trading on all supported exchanges with up to 20 open positions.

- Explorer ($24.16/month, billed annually): This plan unlocks automated trading. It comes with 80 open positions, backtesting, paper trading, and the ability to scan markets with 15 bots.

- Adventurer ($57.50/month, billed annually): For more active traders, this tier increases limits to 200 open positions, faster strategy checks, and allows you to scan with up to 50 bots.

- Hero ($107.50/month, billed annually): The top-tier plan provides access to all features, including the advanced AI strategy designer, market-making, arbitrage, all available coins for signals, and up to 500 open positions.

2. 3Commas – Best for Professional Traders Needing Advanced Control

If you’re a trader who wants deep control over your automated strategies, 3Commas is a platform you’ll want to check out. It’s known as one of the best trading bots for crypto because it provides a professional-grade toolkit that allows for extensive customization. While it has a steeper learning curve, the power and flexibility it offers are well worth the effort for serious traders looking to fine-tune their approach to the market.

3Commas is designed for traders who have experience and want to move beyond basic automation. Its powerful features, like the SmartTrade terminal and custom signal integrations, allow you to execute complex strategies with precision. While it might not be the best cryptocurrency trading bot for beginners, its robust functionality makes it a top choice for those who want to take their trading to the next level.

Pros & Cons of 3Commas

| Pros | Cons |

| Highly customizable bots with robust backtesting for advanced strategies. | Can be complex and overwhelming for new traders. |

| SmartTrade terminal offers granular control over trades. | The most powerful features require a paid subscription. |

| Supports a wide range of popular exchanges (15+). | Requires active management and adjustments. |

Trading Strategies

3Commas provides a versatile set of bots and tools to support various trading approaches. You can implement strategies such as:

- DCA (Dollar-Cost Averaging) Bots: One of the most flexible bots on the platform, allowing you to average down your entry price on positions.

- Grid Bots: Ideal for sideways markets, this bot places a series of buy and sell orders within a set price range to profit from small fluctuations.

- Signal Bots: You can automate trades based on custom signals from TradingView, turning your technical analysis into automated actions. This makes it a contender for the best AI crypto trading bot when paired with sophisticated external signals.

- SmartTrade: This isn’t a bot but a terminal that lets you set up advanced orders with features like trailing stops and multiple take-profit targets, giving you enhanced control over manual or semi-automated trades.

Pricing Plans

3Commas offers a few different plans to match your trading activity and needs.

- Starter ($15/month, billed annually): A basic plan for getting started with core bots on one exchange.

- Pro ($40/month, billed annually): This popular plan unlocks more bots and active trades across three exchange accounts and includes futures trading.

- Expert ($160/month, billed annually): Designed for power users, this plan offers exceptional limits on bots and trades, full backtesting history, and API access for up to 15 exchanges.

3. Pionex – Best for Risk-Free Traders

Pionex is an exchange and trading bot platform rolled into one. If you want a stress-free start in automated crypto trading. Instead of jumping through hoops with API connections, you can sign up, add funds, and launch a bot in just a few clicks. With 16 free, built-in bots available right on the platform, it’s especially handy for anyone who doesn’t want to deal with complicated setups.

Pionex is hands-down the best free crypto trading bot option for beginners and value-focused traders. Everything’s integrated, so you don’t pay extra for bots, and you won’t have to worry about tech headaches. If you’re on a budget or still learning, it’s a great way to experiment with different trading approaches before jumping in deep.

Pros & Cons of Pionex

| Pros | Cons |

| Quick, beginner-friendly setup with simple, no-frills interface | Only works on the Pionex exchange |

| All 16 bots are free—no monthly subscription | Limited customization for advanced strategies |

| Mobile app for iOS and Android | Not the best fit for pro traders who want total flexibility |

| Clear, low trading fees (0.05%) | Fewer coins than you’ll find on major, global exchanges |

Trading Strategies

Pionex lets you try a solid mix of automated strategies, from straightforward to advanced:

- Grid Trading Bot: Place buy and sell orders within your chosen range, aiming to profit from price swings. Great for trending and sideways markets.

- DCA (Dollar-Cost Averaging) Bot: Invest a set amount at regular times, helping reduce the impact of volatility.

- Rebalancing Bot: Stick to your ideal crypto portfolio mix by automatically reallocating your holdings at intervals you set.

- Spot-Futures Arbitrage Bot: Earn steady returns by exploiting price differences between spot and futures markets, built for those comfortable with a bit of complexity.

- AI Strategy: Not sure how to set up your grid or DCA parameters? Use Pionex’s best AI crypto trading bot function to have the platform choose settings based on past market data.

Pricing Plans

Bots are 100% free at Pionex, there’s nothing to unlock or subscribe to. The only fee you’ll encounter is a flat 0.05% trading charge on each executed trade, which is among the lowest in the industry. So, whether you’re running one bot or all 16, you only pay as you trade, making it budget-friendly and accessible for any level of trader.

4. Coinrule – Best for No-Code Automation

Coinrule is designed to make automated crypto trading accessible to everyone, regardless of their coding knowledge. It’s built on a simple logic, allowing you to create trading rules in a way that feels like building with LEGO blocks. If you’ve been interested in using a trading bot but feel intimidated by the technical complexity of other platforms, Coinrule offers a refreshing and straightforward alternative. It empowers you to automate your strategies across multiple exchanges without writing a single line of code.

Coinrule is the perfect choice for traders who want to automate their strategies without the technical headache. Its intuitive, rule-based editor makes it arguably the best crypto trading bot for beginners who want to move beyond simple buy-and-hold strategies. You can choose from over 200 pre-built templates or create your own custom rules from scratch. The platform’s user-friendly design lowers the barrier to entry, making it easy to get your automated strategies up and running.

Pros & Cons of Coinrule

| Pros | Cons |

| Extremely user-friendly with its “if-this-then-that” logic. | The free plan is quite limited in trading volume and features. |

| Wide range of pre-built template strategies. | The most advanced features, like ultra-fast execution, are on the more expensive Pro plan. |

| Supports popular exchanges like Binance, Coinbase, and Kraken. | Fewer advanced indicators compared to more technical platforms. |

| Includes a free plan, making it a great free crypto trading bot to learn with. | No dedicated mobile app. |

Trading Strategies

The strength of Coinrule lies in its Lego-like approach to building trading strategies. You can combine different conditions and actions to create a rule that perfectly fits your market outlook. Popular strategies include:

- Rule-Based Automation: The core of the platform. You can set rules like, “If RSI on BTC goes below 30, then buy $100 worth.” This allows for endless combinations to suit your risk tolerance and goals.

- Trend Following: Create rules that buy into upward trends and sell when momentum starts to fade.

- Dollar-Cost Averaging (DCA): Set up a rule to automatically buy a specific amount of a cryptocurrency at regular intervals, such as daily or weekly.

- Take-Profit and Stop-Loss: Easily build safety nets into your rules, ensuring you lock in profits or cut losses automatically. While it’s not a purely AI-driven platform, you can use its advanced indicators to build what feels like the best AI crypto trading bot strategy for your needs.

Pricing Plans

Coinrule offers a tiered pricing structure that scales with your trading volume and needs.

- Starter (Free): A great way to test the platform. It includes 2 live rules, 1 connected exchange, and a monthly trading volume limit of $3,000.

- Investor ($29.99/month, billed annually): This plan increases your limits to 7 live rules, 3 connected exchanges, and a $500k monthly volume. You also get access to the trader community and leverage trading.

- Trader ($59.99/month, billed annually): For more active traders, this plan offers 25 live rules, 5 exchanges, a $10M volume limit, and advanced features like TradingView integration.

- Fund ($749/month, billed annually): The top-tier plan for serious funds and professional traders, offering unlimited volume, ultra-fast execution, and a dedicated server.

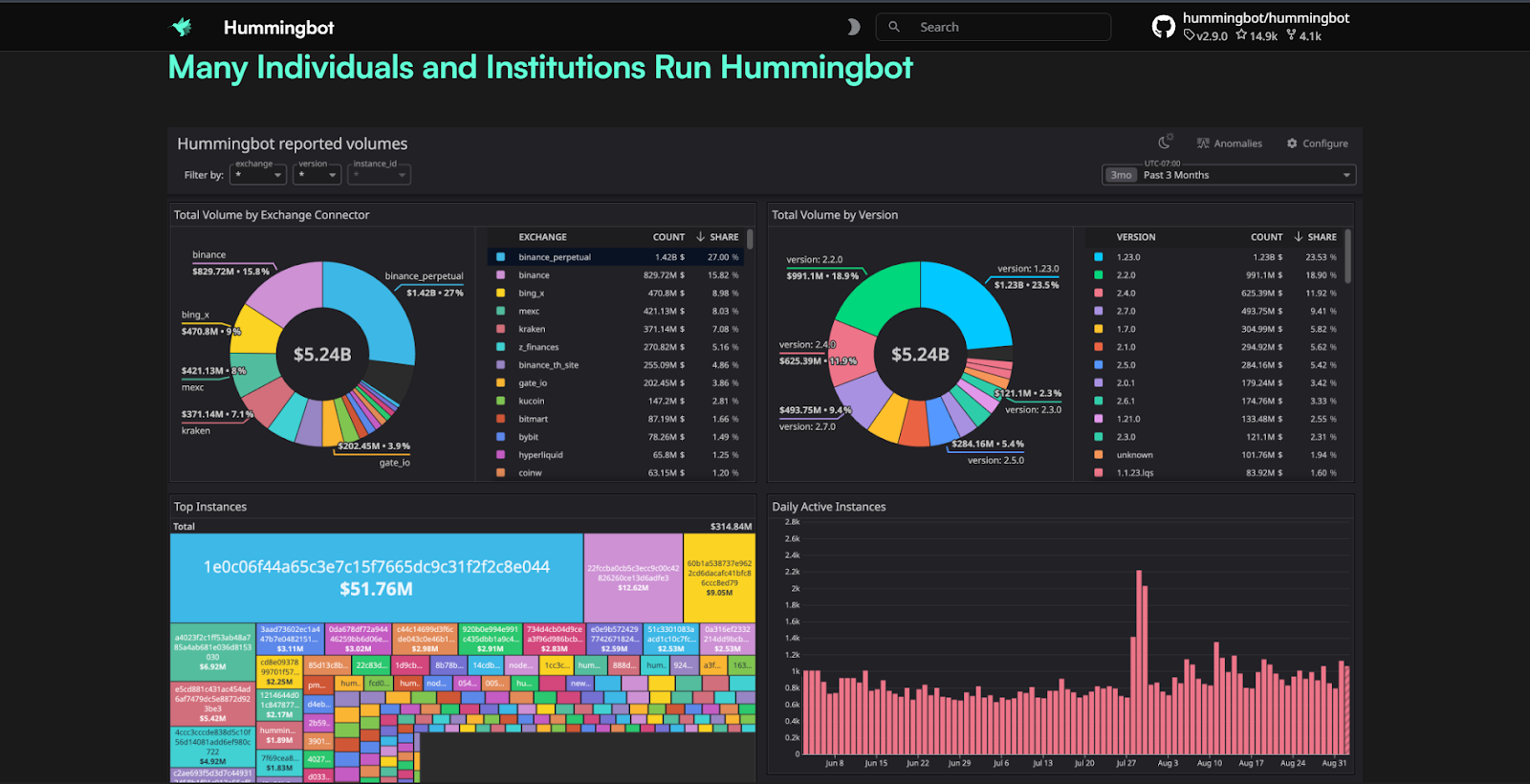

5. Hummingbot – Best for full flexibility without subscription fees

Hummingbot is a free, open-source crypto trading bot built for tech-savvy traders and developers who want full control. It’s best for those interested in coding custom, high-frequency strategies like market making and arbitrage across 40+ centralized and decentralized exchanges.

Pros & Cons of Hummingbot

| Pros | Cons |

| Completely free and open-source | Requires programming knowledge |

| Deep customization for advanced strategies | No graphical interface—command line only |

| Supports 40+ exchanges, including DEXs | Needs self-hosting and manual setup |

| Strong community support | Not suitable for beginners |

Trading Strategies

- Market Making: Earn from the bid-ask spread by placing buy and sell orders.

- Arbitrage: Profit from price gaps across exchanges.

- Liquidity Mining: Get rewards for providing liquidity.

- Custom Scripts: Build and run your own Python-based strategies.

Pricing Plans

Hummingbot is always free to use. The main costs are your exchange trading fees and, if needed, server hosting for 24/7 operation.

6. HaasOnline – Best for Advanced Traders

HaasOnline stands out for traders who value privacy and deep customization. By letting you host the platform on your own hardware, your trading data and API keys stay private. Its HaasScript language and visual editor make it possible to build advanced custom strategies. This may include market making, arbitrage, scalping, and backtesting without writing complex code.

If you are a privacy-focused trader wanting total control, HaasOnline offers effective autonomy to traders.

Pros & Cons of HaasOnline

| Pros | Cons |

| Keeps all data local/private | Not suitable for beginners |

| Highly customizable with scripts & visual tools | Requires self-hosting for full privacy |

| Supports many exchanges | Pricing is case-by-case |

Trading Strategies

- Arbitrage. You can automate across multiple exchanges to profit from different price points.

- Market marking. The bot gives you the ability to place buy and sell orders to profit from bid-ask spreads while providing market liquidity.

- Scalping: Here is when you can execute your trading based on small price movements using your customized bot.

- Custom strategies: Leverages HaasScript to create unique, advanced trading algorithms tailored to specific needs.

Pricing Plans

HaasOnline now uses custom pricing, but past plans ranged from $7.50 to $82.50/month, depending on features and bot limits. To get a current quote, contact their team directly.

7. Bitsgap – Best for Multi-Exchange Grid and DCA Bots

Bitsgap is perfect if you want to manage trades across multiple exchanges from one place. Its intuitive dashboard connects with over 16 platforms, letting you automate strategies and monitor your portfolio without the hassle of switching tabs.

Bitsgap stands out for users who want to automate trades with Grid and DCA bots across their favorite exchanges. The setup is quick and the interface is very approachable, making it suitable for both beginners and experienced traders.

Pros & Cons of Bitsgap

| Pros | Cons |

| Connects to 16+ exchanges in one dashboard | No ongoing free plan, just a 7-day trial |

| Easy-to-use interface | Higher plans needed for more bots/features |

| Robust Grid and DCA bots | Futures bots and AI features on top plan |

| Demo mode for risk-free practice |

Trading Strategies

- Grid Bot: Automates buy and sell orders within a price range, great for taking advantage of market swings.

- DCA Bot: Invests fixed amounts at intervals to build positions gradually.

- Futures Bot & Smart Orders: Advanced tools for experienced users.

Pricing Plans

- Basic ($23/month): 3 Grid bots, 10 DCA bots, unlimited smart orders.

- Advanced ($55/month): 10 Grid bots, 50 DCA bots, adds futures bots.

- PRO ($120/month): 50 Grid bots, 250 DCA bots, all premium features.

- 7-day free trial available.

8. Altrady – Best for Portfolio Management Traders

Altrady is an all-in-one crypto trading platform that brings portfolio tracking, trading tools, and bot automation together. You can manage multiple exchange accounts, get smart alerts, and use grid or signal bots, all from a single dashboard. Real-time scanners help you spot trading opportunities quickly.

If you are having multiple investments, then Altrady is the best choice for you. With Altrady, you can easily monitor the performance of each investment and make informed decisions on when to buy, sell, or hold your assets. The platform also provides real-time market data and insights to help you stay updated on the latest market trends.

Pros & Cons of Altrady

| Pros | Cons |

| Unified portfolio management across exchanges | Interface can feel overwhelming for beginners |

| Automated bots (Grid, Signal) included | Free plan is very limited |

| Advanced manual trading tools available | Backtesting is a paid add-on |

| Real-time market scanners for opportunity detection | Pricing is billed in Euros |

Trading Strategies

- Risk management. The bot allows for simultaneous setting of stop loss and take profit during trading execution.

- Arbitrage Monitoring: You can use Altrady’s real-time price data and customizable screeners to monitor for price discrepancies across connected exchanges.

- Day Trading: Customizable alerts for price movements, volume spikes, and new listings notify traders of potential entry or exit points, allowing for quick execution through the advanced trading terminal.

Pricing:

- Free plan with basic features

- Basic (€20/month): 5 accounts, 2 bots

- Essential (€35/month): Adds more bots and scanners

- Premium (€63/month): 30 accounts, 50 bots

- Optional backtesting add-on (€7/month)

9. Mizar: Best for both Beginners and Experienced Traders

Mizar is a next-generation cryptocurrency trading platform that combines automated bots, copy trading and social trading features, and portfolio management tools for both centralized and decentralized exchanges. It was launched around late 2021 and aims to serve both beginners and experienced traders through customizable bots and API integration across multiple exchanges. One of its biggest advantages is its pricing model, which eliminates monthly subscription fees. Instead, users pay based on trading volume, performance, or token staking.

Pros & Cons of Mizar

| Pros | Cons |

| No mandatory monthly subscription; users only pay when they trade or profit. | Still a relatively young platform with a smaller track record compared to older competitors. |

| Copy trading and social marketplace allow users to follow and replicate the strategies of experienced traders. | Some advanced features, like grid or arbitrage bots, are still being developed. |

| Supports multiple exchanges, including centralized and decentralized options. | Fee structure may be less favorable for very low-volume traders who do not stake tokens. |

| Offers fee reductions through staking the platform’s token (MZR) or by increasing trading volume. | Limited historical performance data and fewer user reviews compared to established bots. |

Trading Strategies

Mizar supports several types of automated strategies and tools:

- DCA Bots (Dollar Cost Averaging): Automates periodic buys or sells to smooth out entry prices over time.

- API Bots and Smart Trading Terminal: For users who want customized execution, multi-exchange access, and advanced order types such as trailing stops and multiple take profit targets.

- Copy Trading and Social Trading: Users can select a trader or bot from the marketplace and replicate their trades automatically, paying a performance fee only when profits are earned.

- DeFi and DEX Bots: For decentralized trading, users can run sniper bots, set stop loss and take profit levels, and monitor new token launches.

Pricing

- On the centralized exchange side (C Mizar), fees are tied to trading volume and staking of the MZR token. The more you trade or stake, the lower your fees.

- On the decentralized exchange side (D Mizar), users are charged per trade, with maximum fees up to about 1 per cent per trade, reducible to around 0.5 per cent through staking.

- Copy trading marketplace fees are performance based, with traders typically charging between 5% and 50% of profits.

- Some public listings mention optional paid tiers such as a Pay As You Go model with around 0.1% volume cost, a Trader plan around 15 dollars per month, and a Pro plan around 30 dollars per month, though prices can vary.

10. Shrimpy – Best for Long-Term Investors and Automated Portfolio Rebalancing

Shrimpy is built for long-term investors who want to automate portfolio rebalancing and take a hands-off approach. You set your ideal allocations, and Shrimpy’s bot keeps your portfolio balanced automatically. Its social trading tools let you copy top-performing portfolios, so you can learn from others while your assets grow.

Shrimpy is tailor-made for investors who want a simple, set-it-and-forget-it approach to managing their crypto portfolios. It’s ideal if your main goal is to maintain target allocations over time, rather than actively trade. The platform handles the rebalancing automatically, so you don’t have to worry about manually adjusting your holdings. Its social trading feature is great if you want to follow top-performing strategies from other users.

Pros & Cons of Shrimpy

| Pros | Cons |

| Simple and easy to use with a free basic plan | Not built for active or high-frequency trading |

| Great for automated rebalancing | Fewer supported exchanges than competitors |

| Social trading lets you follow top traders |

Trading Strategies

- Index investing. The bot permits creation of custom indices, allowing traders to diversify their investments across multiple assets.

- Social trading. Allows users to follow and copy trades of top-performing traders, making it easier for newbies to learn and benefit from the market.

- Portfolio rebalancing.Automates the process of maintaining a desired asset allocation by periodically adjusting holdings to match predefined percentages.

- Dollar Cost Averaging(DCA). Automates the process of maintaining a desired asset allocation by periodically adjusting holdings to match predefined percentages.

Pricing:

- Zero (Free): One portfolio automation on one exchange

- Standard ($15/month): More portfolios and exchanges, plus portfolio stop-loss

- Plus ($39/month): Highest limits and API access

What Is a Crypto Trading Bot?

A crypto trading bot is an automated software program designed to execute cryptocurrency trades on your behalf. These bots operate based on pre-set rules and algorithms, analyzing market data such as price, volume, and trends to make informed trading decisions. By automating the trading process, they eliminate the need for constant manual monitoring, allowing traders to capitalize on market opportunities 24/7.

There are various types of trading bots crypto, each tailored to specific strategies like arbitrage, market making, or trend following. Some bots are beginner-friendly, offering pre-configured templates, while others cater to advanced traders with customizable features and scripting options. While these tools can enhance efficiency and reduce emotional trading, they are not foolproof and require careful setup and monitoring to avoid losses.

Why Use Crypto AI-Powered Trading Bots?

Using a crypto AI-powered trading bot can transform the way you trade by offering efficiency, precision, and round-the-clock market monitoring. Here are five key reasons why you should consider using one:

- 24/7 Trading: Unlike humans, trading bots never sleep. They monitor the market and execute trades at any time, ensuring you don’t miss out on opportunities in the fast-moving crypto world. This is especially useful for global markets that operate across different time zones.

- Emotion-Free Decisions: Emotional trading often leads to poor decisions. Bots stick to pre-set rules and strategies, eliminating impulsive actions driven by fear or greed. This makes them ideal for maintaining discipline, even in volatile markets.

- Efficiency and Speed: AI-powered bots can analyze vast amounts of data and execute trades faster than any human. Whether it’s spotting trends or reacting to price changes, they ensure you’re always ahead of the curve.

- Customizable Strategies: Many of the best crypto trading bots allow you to tailor strategies to your goals. Whether you’re into arbitrage, scalping, or long-term investing, you can set rules that align with your trading style.

- Accessibility for Beginners: If you’re new to trading, bots can simplify the process. Many platforms offer user-friendly interfaces and pre-configured strategies, making it easy to get started without needing advanced knowledge.

How to choose the Best Crypto AI Trading Bot

Selecting the right crypto AI trading bot begins with clearly defining your trading goals. Are you looking for a bot to automate simple trades, or do you need advanced features like arbitrage and portfolio management? Set clear goals, such as increasing profits, lowering risks, or saving time, and look for a bot that aligns with your strategy. Beginners might prefer bots with pre-configured templates, while experienced traders may need customizable options.

Next, evaluate the bot’s features and compatibility. Check if it supports the exchanges you use and offers tools like backtesting, real-time analytics, and risk management. A good bot should also have a user-friendly interface, especially if you’re new to automated crypto trading. Don’t forget to consider security. Ensure the bot uses encryption and doesn’t store your API keys on its servers.

Finally, think about pricing and support. Some of the best crypto AI trading bots offer free plans or trials, which are great for testing before committing. Compare subscription costs and see if the features justify the price. Reliable customer support is also crucial, as you’ll want quick assistance if you encounter issues.

Conclusion

Crypto AI trading bots have revolutionized the way traders approach the volatile cryptocurrency market. These tools offer unmatched efficiency, operating 24/7 to monitor markets, execute trades, and eliminate emotional decision-making. By automating strategies like arbitrage, market making, and portfolio rebalancing, they cater to both beginners and experienced traders. The best bots combine user-friendly interfaces with advanced features like backtesting, real-time analytics, and customizable strategies, making them versatile for various trading goals. Whether you’re looking to save time, reduce risks, or maximize profits, these bots provide a structured and disciplined approach to trading.

Choosing the right one requires careful consideration of your trading objectives, the bot’s features, and its compatibility with your preferred exchanges. Security is paramount, so ensure the bot uses encryption and doesn’t store sensitive data like API keys. Pricing and customer support also play a crucial role, as some bots offer free trials while others require significant investment. While these tools can enhance your trading experience, they are not foolproof and require regular monitoring and adjustments. With the right bot and strategy, you can handle the challenges of crypto trading with higher confidence and efficiency.

FAQs

What is the best crypto trading bot in 2025?

The best crypto trading bot in 2025 depends on your needs. For beginners, platforms like Pionex or Coinrule offer user-friendly interfaces and pre-configured strategies. Advanced traders might prefer Cryptohopper or 3Commas for their customization and AI-driven features.

Are automated crypto trading platforms safe to use?

Automated crypto trading platforms are generally safe to use if you choose reputable providers. Look for platforms with strong encryption, secure API management, and a good track record in the industry.

Do crypto trading bots really work?

Yes, crypto trading bots really work when set up correctly. They follow pre-defined rules to execute trades, helping you save time and avoid emotional decisions. However, their success depends on market conditions and the strategies you implement.

How do I set up the best AI crypto trading bot?

To set up the best AI crypto trading bot, start by defining your trading goals. Choose a bot that supports your preferred exchanges and offers features like backtesting and strategy customization. Follow the platform’s setup guide to connect your exchange account and configure your bot.

Are crypto bots profitable?

Crypto bots can be profitable if used with well-thought-out strategies and proper risk management. They excel in executing trades quickly and consistently, but profitability depends on market conditions and your bot’s configuration.

How much does a crypto trading bot cost?

The cost of a cryptocurrency trading bot varies widely. Some platforms, like Pionex, offer free bots with low trading fees, while others, like Cryptohopper or 3Commas, charge monthly subscriptions ranging from $15 to over $100, depending on the features.