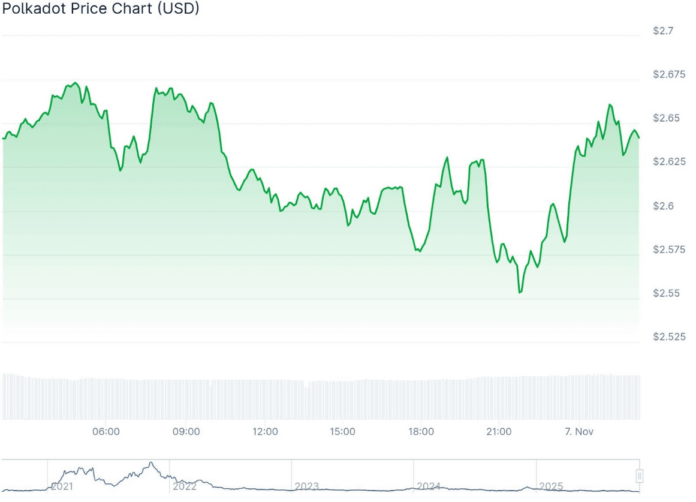

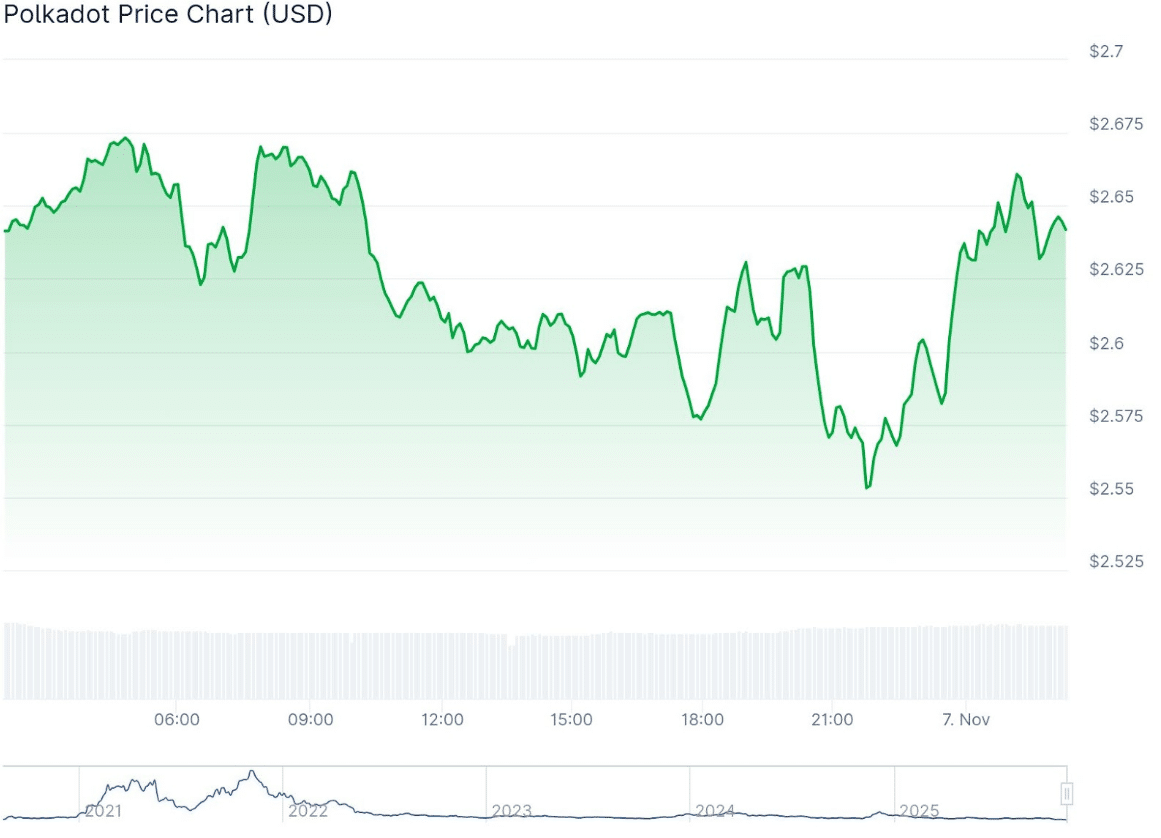

Polkadot’s DOT traded around $2.65 on Friday. The price was flat on the day while traders watched how the network settled after a major upgrade earlier in the week.

DOT’s market value stood near $4.34Bn, with about $260M changing hands over 24 hours.

The quiet trading comes after Polkadot confirmed that its Asset Hub migration finished on Nov. 4. The upgrade was carried out on-chain and completed without issues.

According to the project’s support pages, users did not need to take any action. Developers say the change streamlines the network’s structure and improves how assets move within the ecosystem.

Parity Technologies, which helps maintain the network, described the switch as smooth and said there was no downtime or forks during the process.

Traders are now watching whether the steady price holds as markets adjust to the update, with most looking to see if volatility picks up over the next day.

Parity Technologies said the switch went smoothly. “The Asset Hub Migration is done. No forks. No downtime. Pure on-chain execution,” the team wrote, describing it as a major in-flight rebuild of the network.

Exchanges such as Bitget and KuCoin briefly paused deposits and withdrawals during the transition. These pauses were routine steps taken during large network upgrades.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

DOT Price Analysis: Is Polkadot (DOT) Stuck Below Key Resistance Levels at $3.20–$3.78?

Meanwhile, Polkadot’s DOT is still trading in a tight band. The token shows little strength after recent selling pressure.

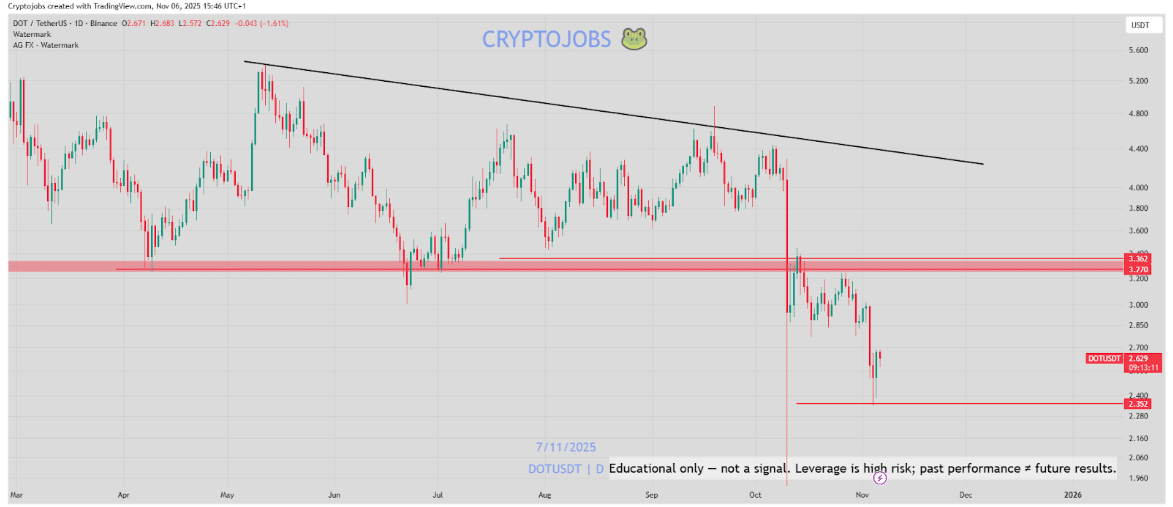

Chart readings show DOT pressed beneath key long-term resistance near $3.20 and $3.78. The market has failed to break those levels several times, which has kept upside attempts short-lived.

The chart shows a long stretch of lower highs under a steady descending trendline. That signals a broader bearish mood that has been in place for months.

On the daily chart, DOT is trading in a narrow band between $2.50 and $2.70. Price is quiet here, and the market seems to be waiting for a clear push in either direction.

The area around $2.35–$2.50 is acting as strong support. Sharp wicks near these levels suggest buyers are stepping in each time the price slips, trying to keep it from breaking lower.

How DOT behaves here will likely guide the next move.

DISCOVER: 20+ Next Crypto to Explode in 2025

There’s also an early inverse head-and-shoulders setup forming on lower timeframes. The neckline sits near $2.70, which could become an important signal for short-term traders.

If the price closes above it, sentiment may improve.

A break above the neckline could set up a move toward $2.85–$3.00. That would fit with analyst calls for a short relief bounce of about 5–10%.

But this pattern hasn’t been confirmed yet. Price still needs to close above the neckline with steady volume.

Even if that happens, DOT faces heavy resistance overhead. The $3.20–$3.78 band remains a thick supply zone and could cap any early gains.

Analysts say swing-long trades look risky until the price can reclaim that area.

On the downside, $2.50 is the key support. If it fails, DOT may slip toward $2.35, which previously stopped sellers. A clean break under that level would raise the risk of deeper losses.

For now, DOT sits in a neutral to slightly bearish spot. Any short-term recovery depends on a confirmed breakout above the neckline.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post DOT Price Prediction: Can DOT Break $2.70 as Traders Gauge Post-Upgrade Risks? appeared first on 99Bitcoins.