Bitcoin’s recent momentum has hit a formidable barrier, with the price struggling to push past the $93,000 mark. After a rapid $3,000 surge on December 17, the rally was just as quickly erased, highlighting a frustrating pattern for investors. This isn’t just random market noise; according to on-chain data firm Glassnode, Bitcoin is facing a massive “supply wall” that is capping any further advance.

Here, I, an on-chain analyst who has used Glassnode and CryptoQuant to track Bitcoin cycles since 2017, will analyze why Bitcoin is stuck, if not free-falling.

So, what does that mean? Think of it like a housing market. If thousands of people bought houses in a neighborhood for $500,000, and the price suddenly dropped, what would happen when it recovered back to $500k? Many of those owners would rush to sell just to get their money back. A $100k buyer in October feels the same ‘get-me-out’ panic as any retail trader when the price hits $93k for the fourth time without breaking.

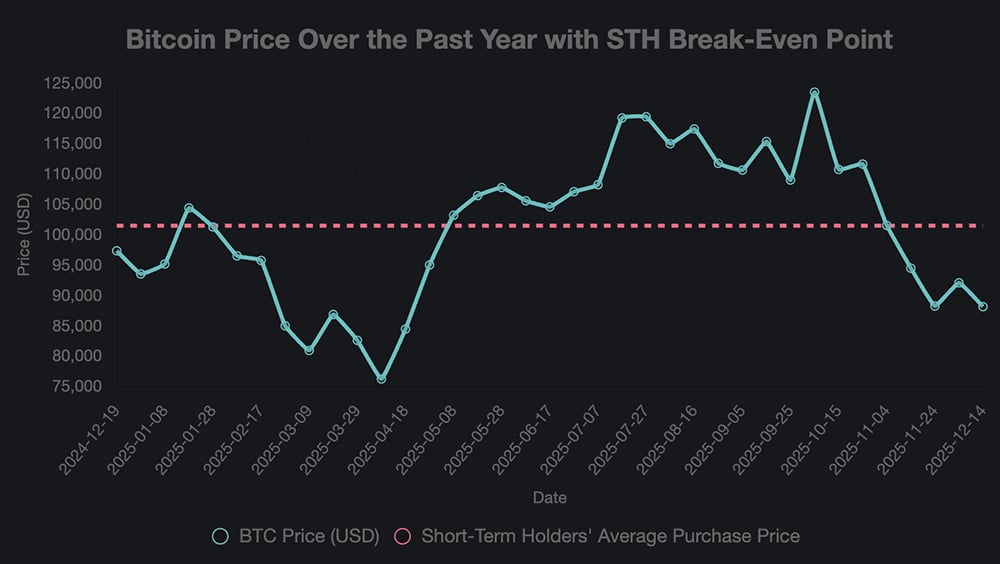

In Bitcoin, a huge number of coins were last purchased between $93,000 and $110,000. These owners are now acting as a ceiling of sellers, preventing the price from rising higher.

Who Are the Sellers Creating This Wall?

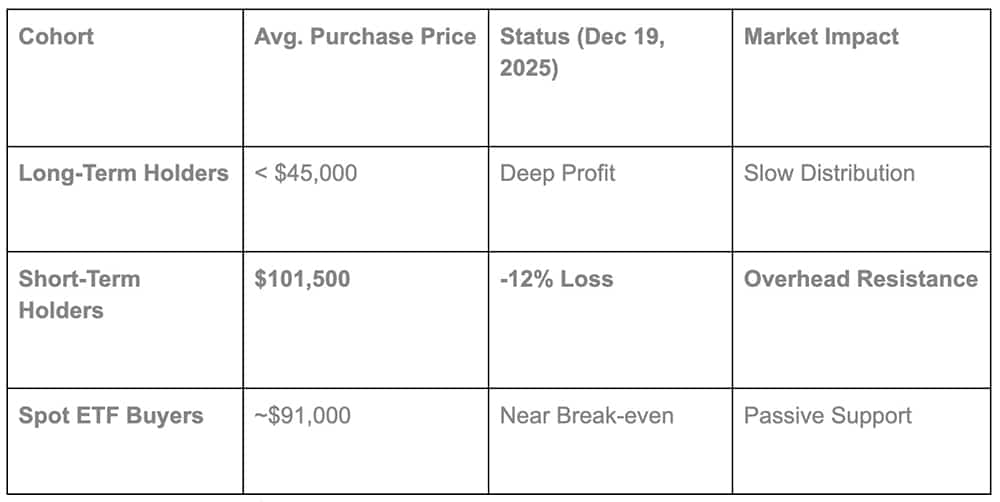

The data points to two main groups. First are the “short-term holders”, people who bought in recently at higher prices. STH-MVRV is currently below 1.0 and their average purchase price sits around $101,500, meaning they are currently at a loss. Any rally toward their break-even point is met with selling pressure as they look to exit without losing money. This creates constant overhead resistance that new buyers are struggling to absorb.

According to reports, the amount of Bitcoin held at a loss has climbed to 6.7 million BTC, a cycle high. This situation creates prolonged stress on holders, a condition that has historically led to sell-offs. While there are periodic bursts of buying from US-based participants, including through vehicles like the BlackRock Bitcoin ETF, it hasn’t been enough to create sustained accumulation.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Is There Any Hope for a Bitcoin Breakout Rally?

While the supply wall presents a major hurdle, it’s not permanent. While the headlines focus on $93k, I’m watching the ‘Max Pain’ point for the Dec 26 expiry, currently sitting near $88,000. This suggests that market makers have a massive incentive to keep the price pinned below $90k until next Friday, which explains the constant rejection we’re seeing.

For a true breakout to happen, the market needs a new wave of strong, conviction-driven buyers to absorb the massive supply waiting to be sold. We’ve seen moments of strong demand push the price past this level before, as noted by CoinDesk. However, current Bitcoin Widerstandsniveaus are being heavily defended.

Until a significant catalyst drives new capital into the market, such as major institutionelle Bitcoin-Käufe, expect the price to remain constrained. This is a structural challenge, not just a temporary dip. The market is caught between dip-buyers below and a wall of break-even sellers above.

For now, the battle for $93,000 continues, defining the line between a market correction and the resumption of a bull run.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Why Bitcoin Rally Is Hitting a ‘Brick Wall’ at $93,000 appeared first on 99Bitcoins.